Finance

Litelite can offer multiple finance options on behalf of our independent providers who specialise in green initiatives, covering the entire cost of the lighting products and installation with repayments being made from the savings achieved. This is designed to help business owners to employ more green technologies in their properties. The idea is simple; install new green technology into your property with no up-front costs. You will pay back the costs through your energy bill’s savings over 2 to 5 years.

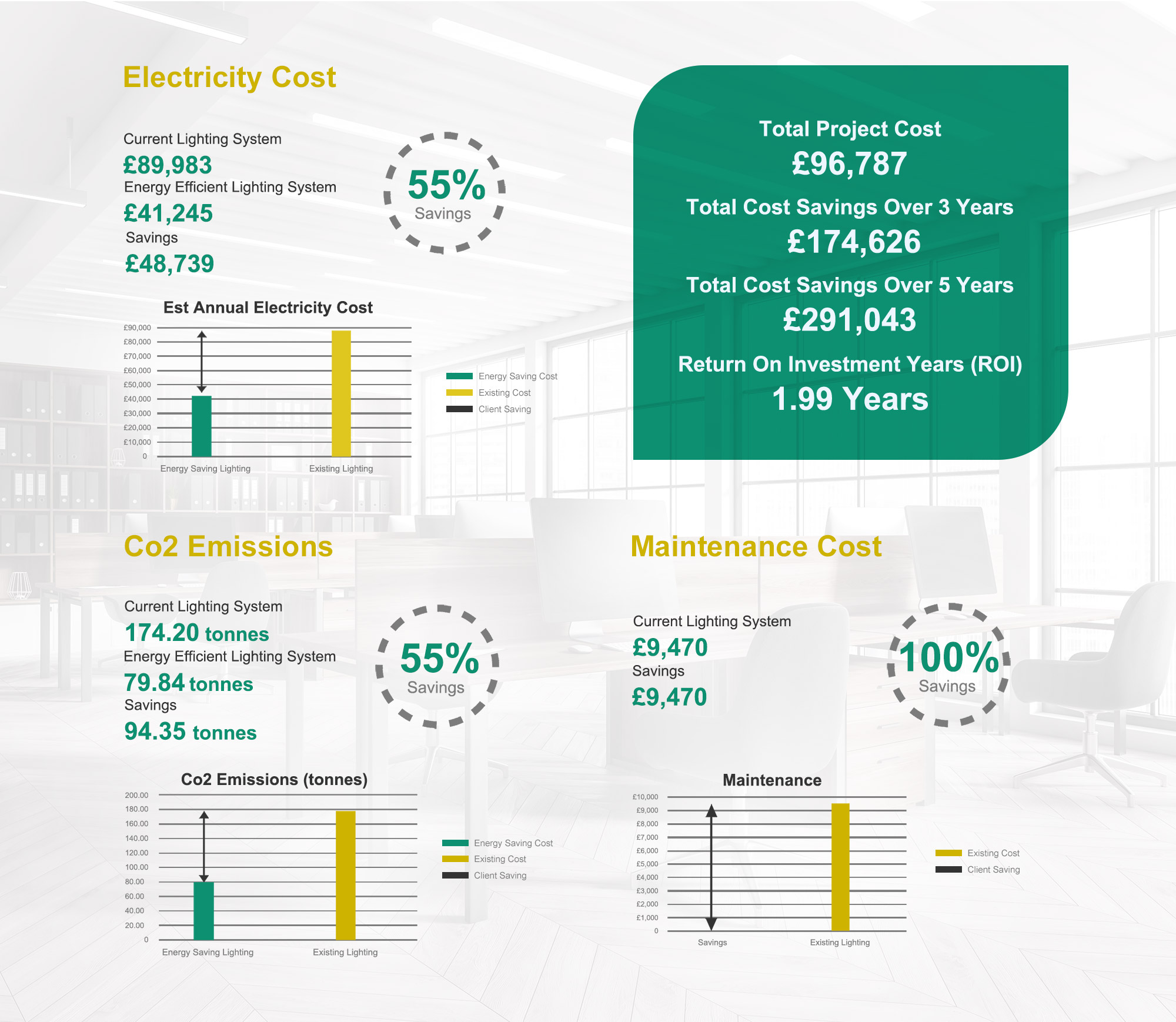

Investment

You will see the benefit from our new environmentally friendly, highly efficient and low energy lighting technology instantly. The energy savings from installing our lights could be significantly greater than the repayments, giving you a cash surplus. The repayments are arranged over an agreed period of time (2 to 5 years) and are 100% tax allowable which lets you budget effectively with complete assurance of knowing the costs throughout the contract.

Upgrades

During the contract period you can upgrade or add extra equipment without any penalty, we just simply revise your contract. This will allow you to take advantage of any new lighting technology that comes available ensuring you have access to the latest products and savings.

Super-deduction

A new 130% first-year capital allowance for qualifying plant and machinery assets; and a 50% first-year allowance for qualifying special rate assets.

From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will be able to claim:

- a 130% super-deduction capital allowance on qualifying plant and machinery investments

- a 50% first-year allowance for qualifying special rate assets

The super-deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

Self-funding Intelligent Finance